401k to roth ira conversion calculator

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required.

Roth Ira Calculator Roth Ira Contribution

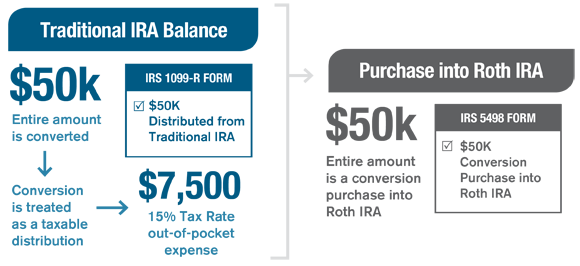

The Conversion Will Trigger Extra Taxes or Costs.

. Find out how much you can contribute to your Solo 401k with our free contribution calculator. 401k Save the Max Calculator. Please verify with your plan administrator that your distribution is eligible for a rolloverconversion.

For example someone withdrawing from a Roth IRA after reaching age 59½ is making a qualified distribution. Traditional IRA vs Roth IRA. Converting to a Roth IRA may ultimately help you save money on income taxes.

Solo 401k Retirement Calculator. A Roth IRA conversion lets you move some or all of your retirement savings from a Traditional IRA Rollover IRA SEP-IRA SIMPLE IRA or 401k into a Roth IRAThere are no age limits to convert and as of January 1 2010 the IRS eliminated Roth IRA conversion income restrictions allowing you to start taking advantage of unique Roth IRA benefits even if your current income. When you do a Roth conversion all of the money you convert from your traditional IRA or 401k will be taxed as income.

Then move the money into a Roth IRA using a Roth conversion. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears.

A Solo 401k plan a SEP IRA a. Learn about Roth IRA conversion. Roth IRAs have income limits.

Is a Roth conversion right for you. Traditional IRA comparison page to see what option might be right for you. As your income increases the amount you can contribute gradually decreases to zero.

For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. The conversion would be part of a 2-step process often referred to as a backdoor strategy. Qualified distributions also include withdrawals at any age that go toward buying building or repairing your first home.

Save on taxes and build for a bigger retirment. First place your contribution in a traditional IRAwhich has no income limits. Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status.

Related Retirement Calculator Investment Calculator Annuity Payout Calculator. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. You can use our IRA Contribution Calculator or our Roth vs.

Partial contributions are allowed for certain income ranges. Home Budget Calculator. However it is not only the taxes that are costly the.

Decide if you want to manage the investments in your IRA or have us do it for you. A conversion can get you into a Roth IRAeven if your income is too high. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be.

A qualified distribution from a Roth IRA meets all the requirements to be a tax-free withdrawal. Owner partners and spouses have several options for tax-advantaged savings. Traditional IRA contributions are not limited by annual income.

Find out which IRA may be right for you and how much you can contribute.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Converting Your Traditional Ira Janus Henderson Investors

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

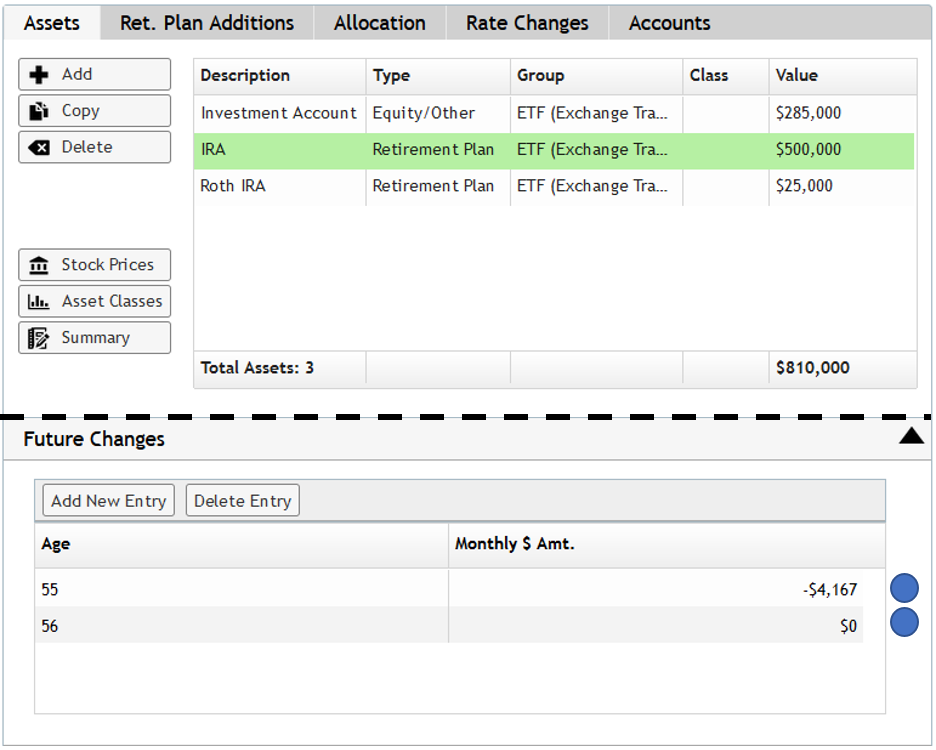

Converting An Ira To Roth Ira In Moneytree Plan Moneytree Software

Roth Ira Conversion Ameriprise Financial

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Over The Roth Ira Income Limit Considering A Backdo Ticker Tape

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most